We encourage senior leaders to read our Choosing secure and verifiable technologies: Executive guidance publication, an executive summary of this advice, to make better-informed assessments and decision making regarding secure technologies.

Introduction

With an ever-growing number of cyberthreats endangering users’ privacy and data, organisations must ensure they are consistently choosing secure and verifiable technologies. Customers are responsible for evaluating the suitability, security and risks associated with acquiring and operating a digital product or service. However, it is important that customers increasingly demand manufacturers embrace and provide products and services that are Secure by Design and Secure by Default. In this way, consumers can increase their resilience, reduce their risks and lower the costs associated with patching and incident response.

When an organisation has determined a need to procure a digital product or service, it must consider whether the product or service is secure and that security will be maintained throughout its specified lifecycle. Inadequate or poor security may expose organisations to increased and possibly unmanageable risks and higher operational costs. Proactive integration of security considerations into the procurement process can assist in managing and significantly mitigating risks and reducing costs.

While procuring organisations should endeavour to ask as many of the questions recommended in this paper as possible, it may take time for manufacturers to adapt their behaviours and practices to provide adequate answers. Ultimately, procuring organisations must ensure they have gathered sufficient information to make an informed decision.

The Australian Signals Directorate’s Australian Cyber Security Centre (ASD’s ACSC) and the following international partners provide the recommendations in this guide as a roadmap for choosing secure and verifiable technologies:

- Cybersecurity and Infrastructure Security Agency (CISA)

- Canadian Centre for Cyber Security (CCCS)

- United Kingdom’s National Cyber Security Centre (NCSC-UK)

- New Zealand’s National Cyber Security Centre (NCSC-NZ)

- Republic of Korea's National Intelligence Service (NIS) and NIS' National Cyber Security Centre (NCSC)

Audience

This paper is written for:

- Organisations who procure and leverage digital products and services. Otherwise referred to as procuring organisations, purchasers, consumers and customers in this paper.

- Manufacturers of digital products and services.

Key personnel who should read this guidance include, but are not limited to, organisation executives, senior managers, cybersecurity personnel, security policy personnel, product development teams, risk advisers and procurement specialists.

This paper is designed to be read by all audiences in its entirety, to:

- Inform organisations of Secure by Design considerations for the procurement of digital products and services, resulting in better-informed assessments and decisions.

- Inform manufacturers of Secure by Design considerations for digital products and services, resulting in increased development of secure technologies. This paper provides manufacturers with key security questions and expectations they can anticipate from their customers. It is not expected that manufacturers will be able to answer every question in this paper. However, they should nonetheless endeavour to provide as much information as possible and appropriate to assist customers.

This paper is not a checklist, and should not be understood to provide absolute or perfect digital procurement outcomes. Rather, it is designed to assist procuring organisations to make informed, risk-based decisions within their own operational context. Every organisation is unique in its structure and approach to procurement, and as such, every item in this paper may not be relevant. Additionally, organisations may need to take other items into consideration that are not covered in this paper, that may be unique to the organisation itself or the industry or region in which it operates.

This document assumes a moderate level of computing and cybersecurity knowledge on the part of the reader.

Understanding Secure by Design

Secure by Design is a proactive, security-focused approach taken by software manufacturers during the development of digital products and services that requires the purposeful alignment of cybersecurity goals across all levels of the manufacturing organisation. Secure by Design requires that manufacturers consider cyberthreats from the outset to enable mitigations through thoughtful design, development, architecture and security measures. Its core value is to protect user privacy and data, by advocating for the design, build and delivery of digital products and services with fewer vulnerabilities.

Procuring organisations should understand the Secure by Design principles and practices manufacturers should be applying when producing digital products and services to make informed, secure choices.

By investing in secure products and services, organisations can reduce operating costs over time, enhancing profitability and organisational reputation to build long-term, sustainable corporate value.

Section One – Understanding the risk of technology procurement

Cyberattacks continue with increasing frequency worldwide, presenting significant challenges for organisations to defend their information environments from persistent and capable threat actors. The procurement of any digital product or service increases the attack surface of an organisation’s information environment. It is critical for organisations to understand the threat environment and the possible supply chain attack vectors so they can identify and manage the risks through pre-purchase and post-purchase risk management.

Threat environment

Knowing the current and emerging threat environment when procuring digital products and services informs decision making to appropriately manage risks that an organisation faces. There are many opportunities for malicious actors to compromise digital products or services through the supply chain. Understanding the ways in which malicious actors can compromise digital products or services empowers organisations to demand that technology manufacturers provide evidence of mitigations against potential threats.

Organisations can stay informed by following these advisories and alert services:

- https://www.cyber.gov.au/about-us/view-all-content/alerts-and-advisories

- https://www.cisa.gov/news-events/cybersecurity-advisories

When procuring digital products and services, the supply chain risks are not just that of the supplier but that of the supplier’s supply chain. All technology manufacturers will have their own suppliers who in turn have their own suppliers, all of whom are susceptible to the same risks as the technology manufacturer supplying to the end technology consumer. Compromise at any of these points in the supply chain can result in the compromise of the end consumer.

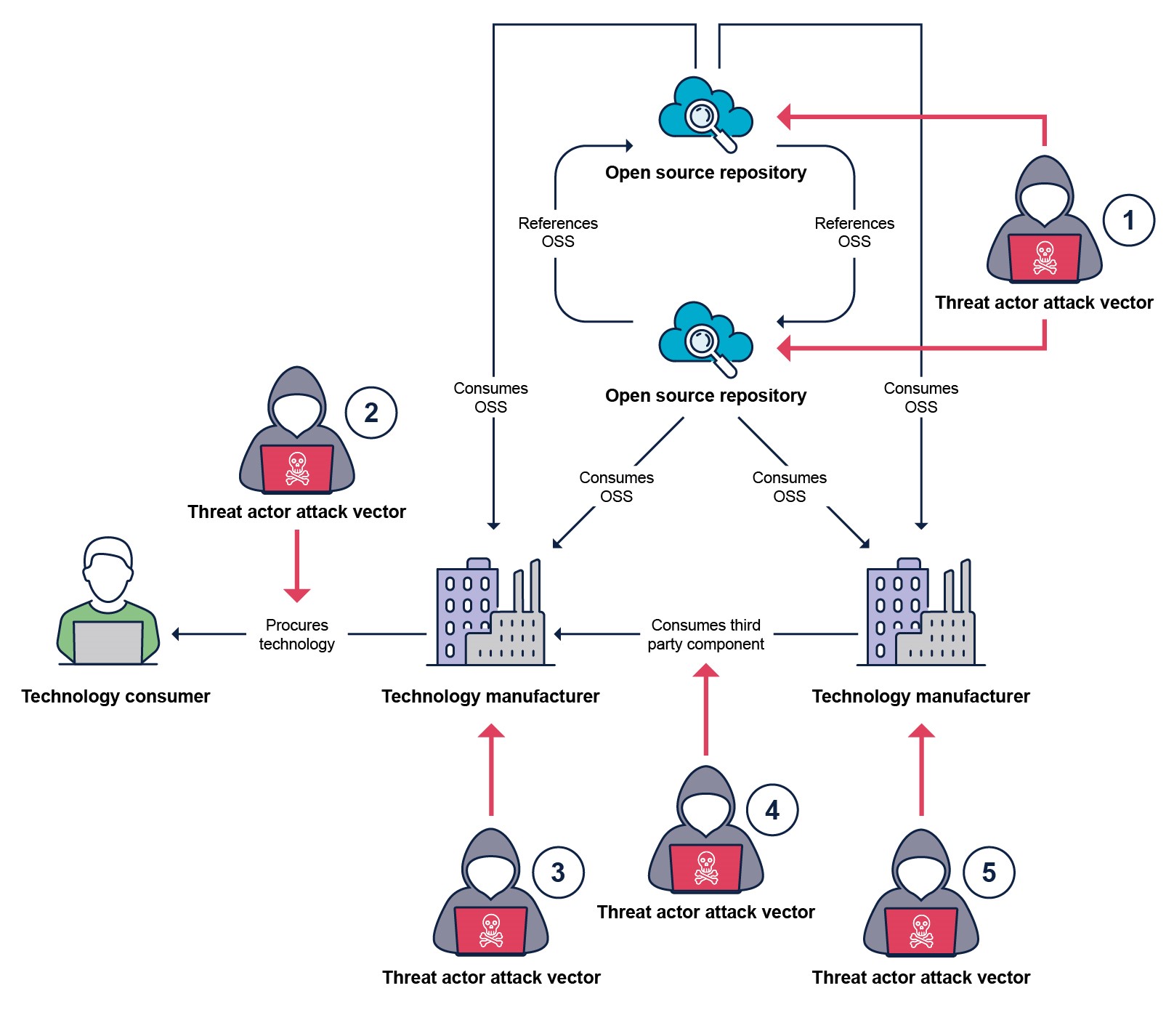

The diagram below details the points in the digital product or service procurement supply chain at which a malicious actor may attempt to cause compromise. The diagram simplifies the supply chain down to a single use open-source software (OSS) source and a single third-party technology supplier. In nearly all situations the supply chain will have many OSS sources and proprietary technology providers in their full supply chain. However, the points of attack will be the same between each of the additional links in the supply chain.

The following table outlines some of the possible attack vectors or actions a malicious actor may take to compromise an end consumer and the strategies that technology manufacturers should have in place to mitigate these attempts.

| Threat actor attack vector | Possible malicious action or attack | Possible mitigation strategies |

|---|---|---|

1 | Malicious code injection into legitimate open-source software packages. | The technology manufacturer has mitigations against ingesting malicious open-source content through secure development practice including, content scanning, verified sources, testing and code review. |

| Development of malicious open-source software package disguised as legitimate packages. | The technology manufacturer has mitigations against incorporating malicious open-source content through secure development practice including, content scanning, verified sources, testing and code review. | |

| Misconfiguration or vulnerabilities added by legitimate contributors by mistake to open-source software packages. | The technology manufacturer has mitigations against incorporating malicious open-source content through secure development practice including, content scanning, verified sources, testing and code review. | |

| A known class of vulnerability is embedded within the product or service. | The technology manufacturer has methods for identifying, correcting and mitigating known classes of vulnerabilities. | |

2 | Delivery of a malicious or vulnerable product or service. | The supplying technology manufacturer provides a secure process for verifying the legitimacy of the supplied product or service such as digital signatures, bill of materials and anti-tampering mitigations and can provide evidence of their Secure by Design practices and risk mitigations. |

| Delivery of a malicious or vulnerable patch. | The supplying technology manufacturer provides a secure process for verifying the legitimacy of the patch such as digital signature and provides a method for managing the patching process and schedule. | |

| A malicious actor intercepts the transfer process and manipulates the provided content. | The supplying technology manufacturer provides a secure process for verifying the legitimacy of the received content. | |

3 | A trusted insider makes a malicious change to the product or service to be delivered to a technology consumer. | The supplying technology manufacturer applies insider threat mitigations to prevent malicious changes, such as verifiable change control, employee security screening and training and other Secure by Design mitigations. |

| A known class of vulnerability is embedded within the product or service. | The supplying technology manufacturer has mitigations in-place for eliminating the root cause of known classes of vulnerabilities, following good Secure by Design practices. | |

4 | Delivery of a malicious or vulnerable product or service. | The supplying technology manufacturer has a process for verifying and validating legitimacy of a third-party product or service such as digital signature and verifies the evidence of their suppliers Secure by Design practices and risk mitigations. |

| Delivery of a malicious or vulnerable patch. | The supplying technology manufacturer has a process for verifying and validating the legitimacy of the patch and can manage the patch process and scheduling. Additionally, they must verify the evidence of their suppliers Secure by Design practices and risk mitigations. | |

| Delivery of a malicious or vulnerable package or source code. | The supplying technology manufacturer has a process for verifying and validating source code or content, such as vulnerability scanning, dynamic and static application security testing and malware scanning. Additionally, they must verify the evidence of their suppliers Secure by Design practices and risk mitigations. | |

| A malicious actor intercepts the transfer process and manipulates content for a malicious purpose. | The supplying technology manufacturer has a process for verifying and validating received content, such as vulnerability scanning, dynamic and static application security testing and malware scanning. Additionally, they must verify the evidence of their suppliers Secure by Design practices and risk mitigations. | |

5 | A trusted insider makes a malicious change to the product or service being delivered to a supplying technology manufacturer. | The supplying technology manufacturer has validated and verified the mitigations implemented by its suppliers, such as verifiable change control, employee security screening and training and other Secure by Design mitigations. |

| A known class of vulnerability is embedded within the product or service. | The supplying technology manufacturer has validated and verified the mitigations implemented by its suppliers, such as vulnerability scanning, dynamic and static application security testing and other Secure by Design practices. |

Section Two - External procurement considerations

The following considerations have been developed to assist organisations who are purchasing products and services to make informed and secure choices. When assessing a manufacturer and their product or service offering, procuring organisations should follow a two-staged approach: pre-purchase and post-purchase. This approach assesses the baseline security of a technology and the likelihood of security being maintained throughout its lifecycle.

If at any point during assessment, the risks associated with a chosen product or service exceed an organisation’s acceptable risk tolerance, the organisation should develop appropriate mitigations or consider whether to discontinue the procurement and explore alternative options that pose less risk.

The considerations below do not represent an exhaustive list. Depending on their unique circumstances, organisations may need to account for additional matters not covered in this paper.

Manufacturers can leverage this guidance to ensure they have the necessary information and supporting artefacts to help procuring organisations make informed decisions.

For additional procurement resources, please visit Connected Communities Procurement and Implementation Guidance.

Pre-purchase

Before purchasing a product or service, the purchaser should evaluate both the product itself and the manufacturer. The pre-purchase assessment phase includes completing low-cost checks before committing to a more extensive evaluations process. The purchaser should check that the manufacturer is striving to produce secure products and the product being procured is within the purchasing organisation’s risk tolerance.

It is important for the purchaser to consider the potential consequences of purchasing a product that is not secure and verifiable and which may be outside their organisation’s risk tolerance. Key consequences that should be considered include, but are not limited to:

- Costs and revenue: there are increased operating costs associated with incident response and productivity loss when a cyber incident occurs, as well as increased routine operating costs for managing patching schedules. Not investing in secure and verifiable products and services increases the risk of cyber incidents and requires more regular patching.

- Reputation: customer confidence in an organisation can be damaged by choosing products and services that are not secure and verifiable.

- Long-term profitability: a poor approach to cybersecurity can increase long-term, systemic risks impacting profitability as threat vectors increase and more vulnerabilities are exposed.

- Consequential losses: what damage an adversary might inflict upon an organisation if the service was not secured against that adversary. This may include loss of client confidence, exfiltration of intellectual property or other confidential information, disrupted business during downtime, ransoms, extortion or other loss.

Transparency and reporting

Organisations should take steps to verify that the advice they are receiving from manufacturers is open, honest and transparent.

Manufacturer transparency can take many forms including attestations, industry reports, independent testing, staying abreast of security trends, conducting research and ensuring uptake of proven security features. Transparency should extend across all incident management efforts, including business continuity, disaster recovery and when a product or service is found to be vulnerable.

Flexibility and a willingness to work within an organisation’s procurement requirements and processes is often an indicator of manufacturer transparency.

Reporting

Manufacturers should make every effort to notify customers of any vulnerabilities identified in their products and services. Notifications should be accompanied by complete, straightforward guidance on how customers can patch or mitigate identified vulnerabilities. Security patches should be supplied at no charge to the customer. Manufacturers must be sure to fulfil any legislative or regulatory reporting requirements they are subject to.

Common Vulnerabilities and Exposures

Common Vulnerabilities and Exposures (CVE) is an industry-led program which allows manufacturers, researchers and individuals to report identified vulnerabilities in a product. These vulnerabilities are catalogued and publicly disclosed.

Manufacturers should publish complete and timely CVEs with associated Common Weakness Enumerations (CWE) for all vulnerable products and services as part of their reporting responsibilities.

Full details can be found at Common Vulnerabilities and Exposures.

Threat modelling

Manufacturers should have a full and detailed threat model for both their organisation and the products and services they are producing. Threat models describe the ways a system might be compromised, including any identified weaknesses and the potential objectives of a malicious actor within the system. Threat models should include the security features and measures a manufacturer is implementing to reduce known risk factors.

A threat model developed early in the software development lifecycle assists the manufacturer in understanding where security features and measures should be prioritised. It is also a valuable tool throughout the development process to provide confidence that new weaknesses are not being introduced via changes in the scope or architecture of the software.

A threat model can also assist the procuring organisation in identifying potential areas to improve security resilience.

For more information on threat modelling, please visit Threat Modeling Manifesto, IT Security Risk Management guidance and Threat Modeling Cheat Sheet.

Reputation

Procuring organisations should take prospective manufacturers’ reputation and trust within the industry into consideration when undertaking procurement. Procuring organisations can consider items including time in business, ownership model, geographical locations of operations, industry and customer reviews and whether the manufacturer is the original product manufacturer or if the technology (or a part thereof) has been bought from a third party. Manufacturers with a history of reputational and trust concerns could pose risks to a procuring organisation. These risks may include poor product quality. Use of disreputable products may cause damage to the procuring organisation’s own reputation.

Attestations

Attestations allow manufacturers to convey to consumers and the industry that they are following a defined security strategy or standard.

Attestations are generally conveyed in two forms:

- A self-attestation, completed by the manufacturer itself.

- An independent attestation, completed by an entity independent of the manufacturer.

Attestations completed against defined standards, such as those listed in the supporting standards appendix, are typically conducted to meet a particular level of maturity. Maturity can be assessed as a crawl/walk/run-style set of characteristics (i.e. practices or processes that represent the progression of capabilities in a particular discipline). It is a tool used to benchmark current capabilities, while identifying goals and priorities for improvement. For example, see the Cyber Capability Maturity Model.

Self-attestations

Self-attestations allow manufacturers to self-assess and measure their progress towards achieving the development and delivery of secure products and services. Manufacturer self-attestations are best employed as a means for manufacturers to understand their own level of maturity.

For more information, please visit CISA Software Attestation and Types of Conformity Assessment.

Independent attestations

Independent attestations involve an impartial entity verifying the claims made by a manufacturer in relation to their organisational and product or service security. The outcome of an independent attestation is to provide procuring organisations with an objective, risk-based assessment. Controls and security measures can be assessed to varying levels of depth, from high-level desktop-based assessments through to in-depth implementation, verification and effectiveness validation. Independent attestations can be made against a recognised industry framework, such as the Information security manual (ISM) or Secure Software Development Framework (SSDF) or can be completed against the manufacturer’s own policies and procedures.

Questions to consider:

When evaluating a manufacturer’s transparency and reporting, procuring organisations should consider:

- Has the manufacturer published threat models of the organisation and its products and services?

- Has the manufacturer published a vulnerability disclosure policy and program, including public vulnerabilities and security reports?

- Does the manufacturer publish accurate and complete CVEs for identified vulnerabilities?

- Does the manufacturer’s reputation fall within the procuring organisation’s risk tolerance?

- Attestation review:

- Have the manufacturer’s organisational security controls been assessed against industry standards?

- Which standard/s and control objectives were followed?

- Is the standard fit for the type of product or service or for its typical use cases?

- Was the attestation independent or self-assessed?

- Have the product or service security controls been assessed against industry standards and control objectives? If so, which standards and was the attestation independent or self-assessed?

- Has the assessment been conducted as a desktop-based assessment or performed via a thorough assessment of controls implementation, verification and effectiveness?

- Has the assessment of the manufacturer and product or service been evaluated against a particular maturity model?

- What was the date and version of the product or service assessed?

- Is the product or service periodically re-assessed and at what frequency?

- If the attestation was self-assessed, would the manufacturer consider a separate independent assessment?

- Have the manufacturer’s organisational security controls been assessed against industry standards?

Can the manufacturer provide a history of previous attestations?

Secure by Default

Secure by Default refers to products that are secure ‘out of the box’ with little to no additional security setup or configuration required upon deployment. It means security measures designed to protect consumers against the most prevalent threats are built into a product or service ‘by default’ at no additional cost. Examples of Secure by Default features include multifactor authentication, audit capabilities, security logging and default configuration settings set at their most secure values. Manufacturers should ensure consumers are aware of the known risks associated with deviating from default configurations. If changes are made consumers should be aware of the increased in likelihood or impact from a compromise unless other security mitigations are implemented.

Questions to consider:

When validating Secure by Default, examples of questions organisations should consider include:

- Does the manufacturer provide all security features in its base product or is the procuring organisation required to purchase additional security packages?

- Are all default configuration options set to the highest levels of security?

- Does the manufacturer supply a guide detailing the risks associated with changing each configuration option and possible compensatory security measures?

- Has the manufacturer confirmed no default passwords exist in the product?

- Has the manufacturer included multifactor authentication or single sign-on (SSO) in the product?

- Does the product audit all changes to configurations and settings?

Security requirements

Procuring organisations must establish, document and understand the predetermined security requirements they need in a product or service. This ensures that products or services being procured can be appropriately evaluated against the organisation’s needs. Not all security requirements will be organisation specific. Organisations may be bound by additional requirements under legislation or regulation.

Procuring organisations should consider security controls that prevent the compromise of data, such as:

- Tokenisation to replace sensitive data.

- Encryption of data, which does not require processing, the use an approved algorithm relevant to the purchaser’s jurisdiction and protection of the decryption key.

- Controls to mitigate threat posed by threat actors identified by the organisation.

- Controls specific to the classification of the data being protected.

Questions to consider:

When reviewing security requirements, examples of questions organisations should consider include:

- What encryption standards are used for data at rest, in transit and in use?

- What identity credentials and access management (ICAM) solutions and protocols are supported?

- Does the product or service offer SSO with an identity solution?

- Have auditing, security information event management (SIEM), security orchestration, automation and response (SOAR) integration rules and support details been provided?

- For Software as a Service (SaaS) solutions, can the data be accessed by a managed service provider (MSP) or cloud service provider (CSP)? If so, how is this controlled and audited?

Supply chain risk management

Manufacturers will most likely have existing suppliers and supply chains on which they depend. The risks associated with a manufacturer’s supply chain are inherited by the procuring organisation. Throughout the lifecycle of a product, accountability resides with the procuring organisation. As such procuring organisations should ensure that the supply chain of the preferred manufacturer aligns with their expectations for security and availability and any risks do not exceed acceptable tolerances. Manufacturers should have a supply chain risk management (SCRM) plan in place to assist in managing supply chain risks.

Additional information is available at Guidelines for procurement and outsourcing, Cyber Supply Chain: An Approach to Assessing Risk , Supply Chain Security, Protecting your Organization from Software Supply Chain Threats and The Threat from Cyber Supply Chains

Manufacturer’s supply chain

The suppliers in a manufacturer’s supply chain can be assessed on their transparency through their policies and whether they offer documents such as software bill of materials (SBOM) and hardware bill of materials (HBOM). These are valuable resources that aid in determining potential supply chain risks as they detail what components and dependencies these suppliers use.

For more information, please visit Cybersecurity Supply Chain Risk Management Practices for Systems and Organisations.

Single supplier reliance

Single supplier reliance can be an issue for both procuring organisations and manufacturers. Procuring organisations should consider the level of reliance they have on any single manufacturer when making a purchase and whether the reliance risk can be mitigated. Manufacturers may face similar risks where they are reliant on a single upstream supplier. Organisations should consider both their own single supplier risk, as well as any upstream single supplier risk on the part of the manufacturer from whom they are purchasing.

Questions to consider:

When assessing supply chain risk management, examples of questions organisations should consider include:

- Does the manufacturer have a SCRM plan in place? Is the plan periodically reviewed and updated?

- Has the manufacturer implemented additional security controls or mitigations to manage supply chain risks?

- Has the manufacturer completed their supply chain due diligence to ensure their suppliers are following a Secure by Design process?

- Has the manufacturer identified any single supplier reliance risks within their upstream supply chain? If yes, have risk mitigations been put in place?

- Has the manufacturer identified and disclosed potential supply chain risks which may affect consumers?

Open-source software usage

Open-source software (OSS) allows software manufacturers to develop software at an increased speed and scale, fostering significant innovation. Software manufacturers must manage risks of OSS as they would for any third-party software. Due to its widespread deployment, security flaws in widely used OSS components can have cascading security effects. Additionally, OSS can be a target of supply chain attacks that seek to compromise upstream open-source dependencies. Manufacturers must own and mitigate risks associated with using OSS.

Manufacturers should exercise due diligence when selecting OSS. For example, manufacturers should avoid OSS components that do not have a community actively monitoring and responding to vulnerabilities.

Manufacturers should be transparent and actively disclose any OSS that is used in their products and services, such as by publishing an SBOM. Procuring organisations should look for manufacturers who maintain an internal secure OSS repository that ensures OSS components (and any dependent components) undergo initial scanning and testing and are continuously checked for updated versions and vulnerabilities. Manufacturers may need to update unsupported OSS components themselves when vulnerabilities are identified or look to replace/remove the vulnerable components.

For more information, please visit Enduring Security Framework and Securing the Software Supply Chain: Recommended Practices for Managing Open-Source Software and Software Bill of Materials.

Questions to consider:

When assessing OSS usage, examples of questions organisations should consider include:

- Have all OSS libraries and components been code reviewed, scanned and tested for malicious content?

- Have all OSS components been included in an SBOM?

- Does the SBOM include all possible inherited components?

- Does the SBOM meet a required specification to support automated monitoring?

- Do all OSS libraries and components have an active community supporting continued development? If not, does the manufacturer have an OSS support plan?

- Has the manufacturer committed to supporting any customised or modified open-source components it uses?

- Has the manufacturer committed to supporting the communities of open-source components it uses?

- Does the manufacturer provide evidence on their OSS management, such as policies, procedures, training, approval and rejection?

- Does the manufacturer have a continued monitoring plan for all open-source components used?

- Has the manufacturer risk assessed the OSS component repositories used, including how contributions and contributors are assessed?

Data sharing and sovereignty

Procuring organisations must have visibility of what organisational and customer data is shared and used by the manufacturer during the procurement process and during use of the product or service. Procuring organisations will need to ensure that data protection security controls pertaining to the manufacturer are sufficient and meet or exceed the same standard they set for themselves.

Consideration should be given to the geographical locations where data is captured, processed and stored by the manufacturer. This is particularly so for procuring organisations who are subject to industry-specific legislative or regulatory requirements on data sovereignty.

Cloud computing

Cloud computing services should be assessed to identify the physical location/s where all data is processed and stored and locations from where data may be accessed, including by remote cloud administrators and support staff. Many CSPs use geographically diverse infrastructure to deliver scalable and reliable services. This means the exact geographical area or region where data is being captured, processed and stored is not always transparent. This may become even less transparent when organisations use SaaS or go through an MSP, as this adds an additional layer of abstraction. Additionally, it may be difficult to identify the supply chain of CSPs. Organisations should request as much information as possible to assist in verifying the security of a CSPs’ supply chain.

Backups and storage solutions

When using backup services, such as archival offsite storage or cloud provider storage, procuring organisations need to be assured of the final resting place of both customer data and their own. Production/live data being stored and processed in one location does not guarantee the location of archived data, which may be stored in a different, cheaper or more convenient location

Questions to consider:

When reviewing data sharing and sovereignty, examples of questions organisations should consider include:

- What data will be shared during the procurement process?

- Will the manufacturer be collecting data while the purchaser is using the product and service? If so, for what purpose?

- What data protection controls does the manufacturer have in place?

- Has the geographical location of all data, including logs, been specified in the contract or configuration? If so, has this been verified?

- Are all backup copies of data, including logs, held in the region specified in the contract or configuration? If so, has this been verified?

Development process

If not managed carefully, there are many activities during the development process that may lead to vulnerabilities or introduce malicious content into products and services. Procuring organisations must be vigilant in ensuring manufacturers are providing sufficient evidence of their development procedures and processes. The evidence provided will assist purchasers in assessing risks and verifying that products and services have been built in line with industry security standards.

Questions to consider:

When reviewing a manufacturer’s development process, examples of questions organisations should consider include:

- Is the manufacturer developing products or services following a Secure by Design methodology or framework?

- Has the manufacturer developed the product or service in a secure development environment? Are they following a defined standard, such as CSA/ANSI T200:22?

- Is the manufacturer providing an attestation against an industry product development standard such as ISM or SSDF?

- What percentage of the product or service has code written in a non-memory safe language? Does the manufacturer have a memory safe roadmap (1-3 years) to reduce or completely remove memory unsafe code?

- Can the manufacturer provide evidence of the testing regimen the product has gone through? For example, penetration testing, unit and integration test coverage and field testing.

Geopolitical risks

Manufacturers must remain vigilant of geopolitical risks that could impact their products and services. Such risks may include trade disputes, changes to import/export laws and regulations, sanctions and political instability, all of which could affect a manufacturer’s supply chain, security and business operation.

Procuring organisations should consider whether a manufacturer actively maintains an awareness of the geopolitical environment and implements mitigation measures against impactful situations. Doing so provides greater assurance regarding the security and continuity of products and services.

Questions to consider:

When evaluating geopolitical risks, examples of questions procuring organisations should consider include:

- Does the manufacturer operate in high-risk regions in any capacity, including within its supply chain? Note, what is considered ‘high risk’ will vary according to organisation, industry and country protocols.

- Are there any trade restrictions, tariffs or similar limitations that may affect the cost, availability or security of the product or service?

- Has the manufacturer assessed and developed mitigations for potential geopolitical tension or military conflict that may impact their supply chain?

- Does the manufacturer provide advice and assurance on their geopolitical risk management? This may include geopolitical forecasting and long-term stability assessments.

Regulated industries

Some industries may need to comply with legislative or regulatory requirements. This can be driven by the sensitivity of data stored or transmitted or if the technology or industry is critical to human safety or national security.

Where applicable, procuring organisations must ensure to validate products and services against relevant legislative and/or regulatory requirements. For example, many organisations in the financial sector handle payment information and must comply with the Payment Card Industry Data Security Standard (PCI DSS). Similarly, healthcare entities must ensure their procurement is compliant with any laws and/or regulations governing the collection and storage of patient health information.

Questions to consider:

When evaluating products and services in a regulated industry, examples of questions organisations should consider include:

- Are there legislative, regulatory or other factors that may impact the manufacturer’s import/export of necessary technologies, components etc.?

- Has the manufacturer provided evidence of legislative or regulatory compliance? If so, how recent is the evidence?

- Will adherence with legislative and/or regulatory requirements significantly impacts the functionality or security of the product or service? If so, does the impact on functionality or security create a potential loss of value?

Manufacturer access

Procuring organisations need to determine whether the manufacturer of a product or service requires physical or virtual access to the procuring organisation’s premises, network or data. The level of access and the associated risks will need to be assessed with consideration given to any required security vetting of the manufacturer’s personnel.

Questions to consider:

When assessing manufacturer access, examples of questions procuring organisations should consider include:

- Is remote access required?

- What authentication and authorisation process will be used?

- Who will be given access?

- What is the frequency and time of access?

- What data and systems will be accessed?

- How will the access be supervised and do the supervisors have knowledge of the product or service?

- Is multifactor authentication mandated for remote access? If not, what are the exceptions?

- How will access be audited?

- Is physical access required?

- Who will be given access?

- What is the frequency and time of access?

- What data and systems will be accessed?

- How will the access be supervised and do the supervisors have knowledge of the product or service?

- How will access be audited?

- What relevant vetting processes have the manufacturer’s personnel undergone?

- What auditing standards and practices will be followed?

- Will all actions be audited?

- Can the procuring organisation conduct its own audits?

- Is any data retained by the manufacturer?

- What data is retained?

- How long is the data retained?

- How is the data secured?

- How is the data disposed?

- Will the manufacturer consent to confidentiality and non-disclosure agreements covering all access to systems and data?

Insider threat

When procuring a product or service, organisations should consider the potential for manufacturer insider threat. In particular, the following types of insider threat have the potential to cause harm:

- Application contributor: has access to alter the code base or configuration of a product prior to it being released to customers.

- SaaS application administrator: has administrative rights to the product and the data it holds.

- Manufacturer installation and support staff: may require remote or on-site access to install, configure or troubleshoot a product or service.

Manufacturers can reduce the likelihood of an insider threat through various controls, such as robust hiring practices, monitoring and change control processes.

For more information, please visit Defining Insider Threats.

Questions to consider:

When reviewing insider threat possibilities, examples of questions organisations should consider include:

- Does the manufacturer have review and change control processes in place?

- Are administrative actions for SaaS products immutably logged and audited?

- Do the manufacturer’s employees go through a security vetting and training process?

- Can the manufacturer provide evidence of workplace culture and training requirements for their employees?

Open standards

Open standards are publicly available specifications or protocols that are developed collaboratively and are not owned, controlled or restricted by any single organisation. They are accessible to the public and anyone can implement them. Open standards should employ the following characteristics:

- Transparency: openly available, allowing for scrutiny by the public and the cybersecurity community.

- Interoperability: compatibility and interoperability between different products and systems.

- Manufacturer-neutrality: no single manufacturer has exclusive control over standards, reducing the risk of manufacturer lock-in.

Open standards facilitate trust between manufacturers and customers by ensuring products and services are built transparently, can be made interoperable and made according to known levels of security.

Questions to consider:

When validating open standards, examples of questions organisations should consider include:

- Is the manufacturer using open standards within their product or service?

- Does the product or service provide interoperability with other industry products and services?

- Does use of the product or service restrict integration or have any manufacturer lock-in impacts?

- Is the standard mature and widely used?

- Is the manufacturer monitoring the standards they use for vulnerability disclosure?

Connected systems

Modern IT systems are increasingly interconnected, requiring both internally and externally connected systems. Examples of internally connected systems include authentication and log administration. Examples of externally (internet) connected functions include transferring or receiving data for actions such as cloud processing. When purchasing a product or service, organisations must consider all systems to which the product or service will be connected. Each layer of interconnectivity increases the product’s risk profile and potential attack surface, require assessment and possible risk mitigation. Managing many interconnected systems can increase an organisation’s administrative overheads and add additional risk.

Questions to consider:

When evaluating connected systems, examples of questions organisations should consider include:

- Does the manufacturer provide a detailed architecture of all interconnected systems?

- Has the manufacturer completed risk assessments against all possible connected systems?

- Does the product establish clear, mandatory requirements for connected systems and the security controls in place?

Product value

Procuring organisations will need to assess the value of a product or service to their unique requirements. While many of the considerations for valuing a product or service are not directly security related, they may have an indirect impact on the security posture of the procuring organisation. Any aspect of a product or service which adds complexity adds risk. If a manufacturer can mitigate or reduce these risks, then the value of a product or service will be greater.

There are multiple criteria which can be used to assist organisations in determining the value of the product to their organisation, these criteria can include:

- The purchasing costs of the product or service and/or ongoing licence fees.

- Anticipated lifetime of the product or service.

- The administrative costs of running the product or service.

- Complexity of integration into the environment.

- The value of efficiency gains (i.e. productivity or functionality made to the organisation with the purchasing and implementation of the product or service).

- The value of the assets (data) managed by the product or service.

Contracts, licensing and service level agreements

When assessing a product or service contract, licensing and service level agreements (SLAs), the purchaser must consider both the contractual obligations and associated security risks that may impact the organisation and their customers. In particular, the purchaser should consider the potential impact if an obligation cannot be fulfilled by the manufacturer or if an element was to fail or not be upheld post purchase.

Considerations:

- Limits of liability.

- Confidentiality requirements for data and information.

- Right to request an audit.

- Right to change without penalty.

- SLAs and rectification or compensation.

- Contractor financial reporting.

- Preventing data loss.

- Contractor insurance.

- Contractor business continuity/disaster recovery plans.

- Backup guarantees.

- Warranties.

- Breach notification.

- Vulnerability Disclosure Program and Vulnerability Disclosure Policy (VDP) Platform (commitment to timely, complete CVEs)

- Requirements on contract negotiation.

- Privacy.

- Security functional requirements.

- Security strength requirements.

- Security-related documentation.

- Security assurance and attestations, including penetration testing and risk assessments, etc.

- Goods/services acceptance criteria.

- Governance oversight and leadership involvement.

- Termination capability and data removal.

- Maintenance, support and reporting obligations.

Asset protection

Processing and storage of data that the product or service will collect, must be considered. Data must be assessed based on its value to both the procuring organisation and its customers, as well as the classification or sensitivity of that data. These factors will determine the value and the associated risk the product brings to an organisation. Additionally, they can be used to determine the mitigations and controls needed to manage risk to an acceptable level. Products that have been identified as built following Secure by Design methodologies bring less risk to the purchaser.

Questions to consider:

When evaluating product or service value, examples of questions procuring organisations should consider include:

- What is the classification or sensitivity of data that the product or service will handle?

- Will the product or service handle customer or user data?

- Will this include sensitive data, such as personally identifiable information?

- Are the inbuilt security controls of product or service adequate for the classification or sensitivity of the data being handled?

- Is the manufacturer able to provide a data model of all data and metadata handled by the product or service?

- Does the cost of the product or service present good value for the data being handled?

- Will the manufacturer commit to the anticipated lifetime need for the product or service?

- Does the product or service require significant administration or management?

- What is the complexity of integration into the procuring organisation’s information environment?

Post-purchase

Following the purchase of a product or service, the procuring organisation needs to ensure that their purchase continues to provide the same level of security as originally assessed.

Risk management

Procuring organisations must ensure that the manufacturer is conducting ongoing risk management of its products and services, as well as its organisational security posture. A product or manufacturer may not have been compromised during initial purchase, but that does not mean they will not become a target in the future. Procuring organisations need to confirm manufacturers are continuously assessing the security of their products and are providing timely updates if issues are identified. Manufacturers should provide ongoing assurance to customers that they are maintaining their security posture.

Questions to consider:

When evaluating risk management, examples of questions organisations should consider include:

- Does the manufacturer provide evidence of its risk management strategies?

- Does the information provided by the manufacturer support continuous improvement and risk mitigation?

- Are manufacturer reports and attestations re-evaluated at defined periods? Are these reports and attestations provided?

- Does the manufacturer have a history of continual maintenance and support for its existing products and services?

Security Incident Event Management and Security Orchestration, Automation and Response

The integration of SIEM and SOAR solutions is important to enable detection and rectification of malicious activities. Both SIEM and SOAR products need detailed logs from an application. It is recommended that manufacturers work with SIEM and SOAR providers to validate that their products are logging sufficient information. Manufacturers and procuring organisations will have different responsibilities depending on whether the product or service is purchaser-hosted or manufacturer-hosted.

Purchaser-hosted

In the purchaser-hosted model, the procuring organisation will be responsible for SIEM and SOAR management. The manufacturer should provide a list of all events that can be raised by the product, including metadata, such as severity, reason code and a correlation identifier. This will enable the procuring organisation to integrate the product effectively into their own SIEM and SOAR systems.

Manufacturer-hosted

The manufacturer-hosted model generally consists of SaaS products or services that a procuring organisation is consuming or that their own customers may be accessing. In this model, the manufacturer is responsible for managing SIEM and SOAR handling for all incidents and events raised. The manufacturer should provide an SLA, which outlines the types of events that are tracked and how they will respond and allow for independent or consumer audits.

Questions to consider:

When evaluating SIEM and SOAR, examples of questions organisations should consider include:

- Have SIEM and SOAR rules been defined for the model being employed, either purchaser-hosted or manufacturer-hosted

- Are the defined rules periodically reviewed for effectiveness?

Maintenance and support

Post-purchase procuring organisations must ensure that manufacturers are adhering to maintenance and support commitments made during the pre-purchase phase of procurement. The security posture of products and services will change throughout their lifecycle as malicious actors discover new vulnerabilities and exploitation tactics, techniques and procedures (TTPs). Manufacturers should support consumers by providing monitoring and maintenance schedules with relevant policies, procedures, supply chains and vulnerability disclosure programs. More information is available at Vulnerability disclosure programs explained and Vulnerability Disclosure Policy (VDP) Platform.

Supply chain monitoring

Procuring organisations will need to monitor as much of the upstream supply chain as possible. In this regard, manufacturers should be supplying documentation on their upstream monitoring capabilities to downstream consumers, including public reporting and notifications on events.

Change management

A robust change management strategy is comprised of multiple strategies that provide ongoing security and business continuity to products and services. Change management will assist in the reduction of insider threats and other vulnerabilities, by assuring that all changes are reviewed, verified and approved. Manufacturers should provide details of the change management policies and procedures to potential customers as part of their Secure by Design disclosure.

Incident management

Manufacturers should provide their incident management policies and procedures. These policies and procedures should be made available as part of the SLAs agreed to between the manufacturer and the purchaser.

Questions to consider:

When validating maintenance and support, examples of questions organisations should consider include:

- Does the manufacturer have vulnerability monitoring and reporting in place for both their product and their supply chain?

- Does the manufacturer have notification and reporting policies and procedures in place? If so, are the specified timeframes suitable?

- Is vulnerability reporting included in the licence or SLA?

- Does the manufacturer provide timely support to maintenance requests?

- Does the manufacturer have policies and procedures in place to respond to identified vulnerabilities, such as a vulnerability disclosure program? If so, are the responses and timeframes suitable?

- Does the manufacturer provide a product roadmap of planned patching and enhancements?

Contracts, licensing and service level agreements

Procuring organisations must confirm that manufacturers are maintaining adherence to all commitments made in the procurement contract, licensing and SLAs. Specific attention to adherence to security and data assurances is recommended.

Questions to consider:

When validating contracts, licensing and SLAs, examples of questions organisations should consider include:

- Have contracts, licensing or SLAs been changed or updated?

- Is the manufacturer adhering to the agreed contracts, licensing and SLAs?

Loosening guides

Loosening guides detail the configuration settings users can change within a product. These guides should provide sufficient detail so that users can make an informed, risk-based decision when changing settings.

Guides should highlight the risks the product or service and/or user are exposed to for each change and offer suggestions on possible mitigations. Where possible, products should alert or prompt users and administrators periodically or during certain actions that the current configuration is less than optimal.

Questions to consider:

When validating loosening guides, examples of questions organisations should consider include:

- Is a loosening guide provided with the purchased product?

- Is the product Secure by Default or will the product require additional configuration to make it secure?

- Are all configuration options detailed, including the level of security they provide?

- Does the manufacturer provide a list of recommended mitigations for when a configuration is altered from its default to ensure a minimum level of security is maintained?

End of life

When a product is no longer in use by a customer, due either to the product reaching its end of life or the customer has decided to discontinue use, the manufacturer must have off-boarding procedures in place. The manufacturer must make the customer aware of the data they are still in possession of and if they will be deleting or storing that data. The manufacturer should provide detailed guidance for securely removing the product as well as guidance for data handling and removal if necessary.

Information disposal or secure storage

When a product or service reaches its end of life, the purchaser must be conscious of the data they have shared with the manufacturer. This data may include company, end user or customer information. If possible, the purchaser should consider asking the manufacturer to securely dispose of all non-essential data. The power to instruct the manufacturer to delete data should be included in the original contract or licence.

SaaS data destruction

SaaS products present additional risks to procuring organisations when trying to decommission a product. Without clear visibility of all data that has been collected or created while using the SaaS product, it may be impossible to verify that all data has been securely deleted. Ensuring robust clauses in the contract or licence can help give assurances to the procuring organisation.

Questions to consider:

When validating end of life, examples of questions organisations should consider include:

- Does the manufacturer disclose the end of life and end of support for the product or service? Is there a policy in place to notify the consumer prior to end of life?

- Does the manufacturer have data disposal policies and procedures?

- Does the manufacturer provide data destruction certificates?

Section Three - Internal procurement considerations

When organisations are procuring a product or service, in addition to assessing the manufacturer, the organisation should assess its own internal policies, procedures and practices. This assessment can be conducted across three stages: pre-purchase, transition to service and operation.

If at any point during assessment, the risks associated with a chosen product or service exceed an organisation’s acceptable risk tolerance, the organisation should develop appropriate mitigations, consider whether to discontinue the procurement and/or explore alternative options that pose less risk.

The below considerations do not represent an exhaustive list. Depending on their unique circumstances, organisations may need to account for additional matters not covered in this paper.

Pre-purchase

During the pre-purchase phase of self-assessment, the purchaser should be consulting with the following areas of their organisation: senior management, policy, infrastructure and security and the product owner. Each of these areas will have specific requirements and insights that will ultimately determine if the risk profile of a product or service makes it suitable for purchase.

Senior management

Senior management need to be provided with the right information to inform procurement decision making.Senior management must empower their personnel to obtain and evaluate the information requirements recommended in this paper to provide risk informed recommendations on procurement options.

The purchasing organisation’s, senior management should be able to answer the following questions during the pre-purchase phase:

- Has an organisational risk framework and threshold been established?

- Have the organisation’s security requirements been established?

- Are the appropriate resources allocated and available to perform the assessment?

- Does the organisation have the right resources to manage and administer the product or service?

- Has senior management been provided with a risk assessment and accepted the risks associated with the proposed procurement?

- Has senior management approved the adding of the product or service to the organisation’s incident response plan?

Internal product owner

The internal product owner is responsible for the business ownership and management of the proposed product or service. It is generally the product owner’s responsibility to ensure that the proposed product is both suitable from a business context and will meet the security requirements of the organisation, before seeking senior management endorsement.

The following questions should be asked of the internal product owner during the pre-purchase phase:

- Does the product meet business needs without exceeding risk tolerance?

- What risk level or security classification level does the purchase need to meet?

- What privacy implications does the purchase introduce? Will it require a privacy impact assessment, to provide a wholistic risk assessment for the procurement?

- Does the proposed contract cover a level of risk and risk mitigation suitable to the organisation?

- Has a risk mitigation plan been established?

Note: If the organisation does not have an assigned internal owner for products or services, it is recommended that a business owner be appointed for the product or service to work with the IT team and other teams across their organisation.

Policy

An organisation’s policy area must be consulted to ensure the proposed purchase meets organisational obligations and policies. Conflicts with existing policies and procedures may indicate that a product is not suitable or pose[JL1] additional risk to the organisation.

The following questions should be asked of policy personnel during the pre-purchase phase:

- Does the proposed purchase conflict with any existing policies?

- Does the proposed purchase level of risk exceed the accepted thresholds for the organisation?

- Does the product or service meet logging and auditing requirements (legislative or regulatory) for the organisation?

- Does the organisation have policies and procedures for conducting periodic re-assessments for the type of product?

- Does the procurement policy cover security assessment of products?

Infrastructure and security

Infrastructure and security personnel must be consulted to ensure that the proposed product is suitable for the organisation’s existing infrastructure and does not increase the risk to existing products and services. Additionally, the specified personnel will have the subject matter knowledge to help assess the security documentation provided for the product or service being procured.

The following questions should be asked of infrastructure and security personnel during the pre-purchase phase:

- What are the current security control catalogues or frameworks that the organisation is willing to accept?

- Has a security impact assessment been completed?

- Has a threat model been completed, with relevant threats and risks identified and the risks managed to an acceptable level?

- Is the logging format of the proposed product or service compatible with the organisations current monitoring solution?

- Is the product or service architecture compatible with the organisation’s infrastructure (i.e. on-prem, containerisation, cloud etc.)?

- Will the proposed purchase impact existing products and services?

- Are supplier personnel security vetted?

Transition to service

During the transition to service phase of self-assessment, the purchaser should be consulting with the following areas of their organisation: senior management, system administration, infrastructure, security and the product owner. Each of these areas will have specific requirements and insights that need to be addressed before the final product is chosen and transitioned into service.

Senior management

Senior management have the final authority to confirm the acquisition of a product or service. For the transition to service phase, senior management require visibility of the risks that must be accepted and managed to proceed. Visibility and understanding of risks are key to procuring secure products.

The following questions should be asked of senior management during the transition to service phase:

- Has a risk assessment been provided for the proposed procurement?

- Have all residual risks been triaged?

- Has the procurement process been adhered to, including the final contract being signed and accepted?

Internal product owner

The internal product owner is responsible for managing the transition of the product or service into the organisation. Once the product or service is endorsed by senior management, they will need to co-ordinate with all the other areas of the organisation to ensure security is maintained into operation.

The following questions should be asked of the product owner during the transition to service phase:

- Has the delivered product and version been verified (digitally signed)?

- Does the final contract meet the organisation’s security requirements?

- Have all assessments and security documents been provided and verified?

- Is secure default configuration being followed? Have all risks and associated explanations been assessed and documented for each deviation?

System administration

System administrators will need to be identified and briefed on new products or services coming online within the organisation. Ensuring administrators understand the security requirements of the incoming product or service will help ensure its level of security is not compromised through administration.

The following questions should be asked of system administrators during the transition to service phase:

- Have all logging and auditing outputs been verified?

- Have all ICAM requirements been identified, assessed and implemented?

- Have all role-based access controls (RBAC) and attribute-based access controls (ABAC) requirements been documented and verified if applicable?

- Are change management processes in place for administration activities?

- Is all security documentation such as system security plans, incident response plan etc. up to date?

Infrastructure and security

Infrastructure and security personnel must support procurement to ensure the proposed product integrates successfully into the organisation. The specified personnel will have to be updated with any supplier information and guidance on technology specifications and requirements including security requirements.

The following questions should be asked of infrastructure and security personnel during the transition to service phase:

- Have infrastructure security controls been implemented (e.g., service accounts with least privilege, isolated networks with only the required resources)?

- Are monitoring systems in place? Are they pre-tuned or in learning mode or has post-tuning been arranged?

- Are third parties being used for operations? If so, what assurance can they provide?

- Has the delivered product or service been scanned for potential compromise?

- Has the delivered product or service been added to the vulnerability scanner?

Operation

During the operation phase (post-purchase) of self-assessment, the purchaser should be consulting with the following areas of their organisation: senior management, system administration, infrastructure, security and the product owner. Each of these areas will have specific requirements and insights that will need to be addressed during the ongoing administration and management of a product.

Senior management

Senior management must continue to support their personnel and organisation to ensure security is maintained throughout the product life cycle. Staying informed of the evolving threat landscape may change an organisation’s risk tolerance and the ability to give authority to operate for each product or service.

Senior management should be able to answer the following questions during the operation phase:

- Have continuous or periodic acceptances and reviews of product risks been established?

- Have system security plans and business continuity plans been created and accepted?

- Have legacy technology risks been added to and managed on an organisation risk register?

- Has senior management approved the adding of the product or service to the organisation’s incident response plan?

Internal product owner

The internal product owner is responsible for the day-to-day management of a product or service once in operation. They must continue to co-ordinate with all the other areas of the organisation to ensure security is maintained throughout the product life cycle.

The following questions should be asked of the product owner during the operation phase:

- Is the manufacturer adhering to claims made during purchase?

- Are periodic contract reviews in place?

- Are changes to the product being risk assessed (e.g., configuration updates and user access)?

- Has a business continuity plan been developed?

- Has a system security plan been developed?

- Are regulatory and legislative requirements being periodically reviewed?

- Does the product or service have a legacy technology roadmap or plan?

System administration

System administrators will continue to support the product or service throughout its life cycle in the organisation. They are essential to maintaining security through quality administration and by reporting on any newly identified risks or anomalies in the product or service that may be an indication of compromise.

The following questions should be asked of system administrators during the operation phase:

- Is monitoring and notification in place for patches, CVEs and product updates for the full supply chain?

- Has product monitoring been provisioned within a SIEM?

- Does the organisation have SOAR capabilities for the product? Have they been provisioned?

- Are procedures set up for data management (e.g., disposal, editing and back-up)?

- Are procedures being regularly tested?

- Has the new product or service been written into the organisation’s incident response plan and has an incident response plan been established specifically for the product or service?

Infrastructure and security

Infrastructure and security personnel must continue to support the operation of a product or service throughout its life cycle in the organisation. The specified personnel will work closely with system administrators and product owners to maintain security and ensure that one product or service does not adversely affect another.

The following questions should be asked of infrastructure and security personnel during the operation phase:

- Are account authorisations, including privilege access, assessed when requested and periodically reviewed?

- Are the manufacturer’s security attestations being periodically reviewed for updates?

- Does the technology used by the product or service have a support roadmap or legacy support plan and has this been identified in the organisation product support plan?

Appendix

Supporting Resources

Secure by Design foundations

The ASD’s ACSC Secure by Design foundations (the foundations) have been designed for both technology manufacturers and consumers, to assist in the adoption of Secure by Design principles and practices. Each Foundation identifies key areas of focus for security uplift and the key risks mitigated.

For more information, please visit Secure by Design foundations.

IoT Secure by Design guidance for manufacturers

The ASD’s ACSC IoT Secure by Design guidance for manufacturers has been developed to help manufacturers implement thirteen Secure by Design principles from the AS ETSI EN 303 645 cybersecurity standard for consumer IoT devices.

For more information, please visit IoT Secure by Design guidance for manufacturers.

Shifting the Balance of Cybersecurity Risk: Principles and Approaches for Security-by-Design and Default

The Shifting the Balance of Cybersecurity Risk: Principles and Approaches for Security-by-Design and Default whitepaper is a co-sealed publication led by CISA. The publication focuses on providing technology manufacturers advice and guidance on developing products with both a Secure by Design and Secure by Default strategy. The publication is underpinned by three founding principles aimed at technology manufacturing leaders. Driven by the understanding that software underpins our essential services, the foundations of our economy and our national security structures, technology manufacturing leaders must:

- Take ownership of customer security outcomes.

- Embrace radical transparency and accountability.

- Lead from the top.

For more information, please visit Shifting the Balance of Cybersecurity Risk.

Minimum Viable Secure Product

Minimum Viable Secure Product is a list of essential application security controls that should be implemented in enterprise-ready products and services. The controls are designed to be simple to implement and provide a good foundation for building secure and resilient systems and services.

For more information, please visit Minimum Viable Secure Product.

Supporting standards

The following standards can be used by manufacturers to assist in the development of secure and verifiable technologies. Manufacturers following one or more of these standards should be able to provide evidence to procuring organisations to support product or service claims.

ASD ACSC Information security manual (ISM)

The purpose of the ISM is to outline a cybersecurity framework that an organisation can apply, using their risk management framework, to protect their systems and data from cyberthreats. ISM.

ASD ACSC Infosec Registered Assessors Program (IRAP)

IRAP endorses individuals from the private and public sectors to provide security assessment services. Endorsed IRAP assessors assist in securing your systems and data by independently assessing your cybersecurity posture, identifying security risks, and suggesting mitigation measures. IRAP.

ISO/IEC 20243-1:2023 Open Trusted Technology Provider Standard (O-TTPS)

ISO/IEC 20243-1:2023 O-TTPS is a set of guidelines, requirements and recommendations that address specific threats to the integrity of commercial off-the-shelf (COTS) hardware and software products throughout the product lifecycle. ISO/IEC 20243-1.

NIST Special Publication (SP) 800-218

The Secure Software Development Framework (SSDF) is a set of fundamental, sound and secure software development practices based on established secure software development practice documents from various organisations. SSDF.

Open Web Application Security Project (OWASP) - Application Security Verification Standard (ASVS)

The OWASP ASVS provides a basis for testing web application technical security controls and provides developers with a list of requirements for secure development. ASVS.

Open Web Application Security Project (OWASP) - Software Assurance Maturity Model (SAMM)

The mission of OWASP SAMM is to be the prime maturity model for software assurance that provides an effective and measurable way for all types of organisations to analyse and improve their software security posture. SAMM.

CISA Cyber Performance Goals (CPGs)

CISA's CPGs are a subset of cybersecurity practices, selected through a thorough process of industry, government and expert consultation, aimed at meaningfully reducing risks to both critical infrastructure operations and people. CPG.

NIST SP 800-53 Rev. 5 - Security and Privacy Controls for Information Systems and Organisations

This publication provides a catalogue of security and privacy controls for information systems to protect organisational operations and assets from a diverse set of threats and risks, including cyberattacks, human errors, natural disasters, structural failures, foreign intelligence entities and privacy risks. SP800-53.

Common Criteria (CC) - Common Criteria for Information Technology Security Evaluation

The CC is the driving force for the widest available mutual recognition of secure IT products. Products can be evaluated by competent and independent licensed laboratories to determine the fulfilment of particular security properties, to a certain extent or assurance. Common Criteria.

CSA/ANSI T200:22

This Standard describes a methodology for assessing the product software and cybersecurity control maturity of an organisation. It covers the entire product system life cycle from conception to full commissioning and until the end of life. It supports effective executive business decisions that establish a comprehensive maturity model approach to cybersecurity. CSA/ANSI T200:22.

Cybersecurity Capability Maturity Model C2M2

The Cybersecurity Capability Maturity Model (C2M2) is a free tool to help organizations evaluate their cybersecurity capabilities and optimize security investments. Cyber Capability Maturity Model.

Categories of digital products and services

Software

Software covers all types of programs/applications, operating systems, embedded systems and firmware. Software is either proprietary (licensed) or open-source (freely available).

Proprietary software

Proprietary or ‘closed source’ software is software that has been developed by a manufacturer and is not freely distributed but made available through a licensing or purchasing agreement. Manufacturers may impose restrictions on proprietary software, such as restricting the number of users or prohibiting resale, redistribution or reverse engineering.

Open-source software

Open-source software (OSS) is a type of software, often including source code, that is distributed with an open license for anyone to view, use, study or modify. Source code is the human-readable language that the software has been written in. OSS is generally managed by a community of volunteers dedicated to its ongoing development and refinement. There are many benefits to using OSS, including the speed with which new products can be built.

Embedded software and firmware